Partners in your growth

At Astute, we work towards long term sustainable wealth creation through investment in equities. We deliver returns for our clients by thinking differently and spotting investment opportunities ahead of the crowd. Governed by values and driven by commitment, we believe in long-term relationships built on trust and mutual growth.

Our Values

About Us

Astute Investment Management Private Limited, erstwhile Aries Stocktrades Private Limited, was incorporated in 1995. It used to offer Stock Broking on NSE and BSE earlier. In 2008, Astute got the Portfolio Management Services (PMS) certification from SEBI and the focus of the company is on managing clients’ wealth by investing in Indian public equities.

Investment philosophy

At Astute Investment Management, we believe in long term value investing, where we look at an investment horizon of at least 2-3 years. We focus on bottom-up stock picking using fundamental research. We look at buying equity shares of a company as buying a piece of its business. The 3 most important aspects that we focus on are :

1. Business

- Business should have good long term prospects and an economic moat (sustainable competitive advantage over other businesses in the same industry and which acts as an entry barrier to competition)

- Scalable business opportunity with a huge opportunity for the company’s products and services in the future

- Easy to understand and more predictable over the longer term – not too many variables or moving parts which can affect the performance of the company

- Generating cash or ability to generate considerable degree of cash without having to resort to much external capital (in the form of equity or debt) and the company does not need to keep reinvesting a good amount of this cash to generate the same income

- Company among the leaders in its industry or has a differentiated business model or operates in its own niche area

- Industry growing fast and/or company growing faster than the industry

- Company’s financial ratios (ROE – Return on equity, ROCE – Return on capital employed) may be already good or we expect them to get better over time due to some catalyst in the company or industry

- We prefer companies whose business is dependent on free market prices (where the company can exercise pricing power) and not subject to government interference and regulations on an ongoing basis

2. Management

- Desire and capability (with the required qualifications, experience and passion) to scale up the business profitably

- Good past track record of capital allocation in their business

- Importance given to corporate governance

- Have accountability to shareholders and run their business with financial discipline and where they can generate higher return on capital than the cost of capital on a consistent basis

- Have not diluted their equity in the past or done so to a minimal level

- Where they payout reasonable amount of dividend to shareholders or have ability to do so in the future

3. Valuation

- While a company may meet the criteria of good business and management, it should also be trading at cheap or reasonable valuations (on the basis of market cap to sales; enterprise value to ebitda; price to earnings etc)

- The company’s stock should not discount the future too far out and have lofty expectations built into the price and there should be a margin of safety (in case things don’t play out as per our expectations)

- As it’s said that beauty lies in the eyes of the beholder, valuation is a very subjective thing and we try to gauge sentiment surrounding the company and would be generally more interested if people are skeptical of the company and the stock is pricing very limited growth or profit potential in the future and we believe that the market is underestimating the future potential

Even though we are multi-cap oriented, we invest with a preference for mid to small sized companies. We believe that a portfolio should not have more than 8-12 stocks, which we believe provides enough diversification. We track the developments in the companies and their respective industries, without being too affected by short term stock price movements. We don’t believe in churning the portfolio to generate brokerage. We let compounding do the work for us. If we do not find attractive investment opportunities, we are fine with holding some degree of cash in our portfolios as we would like to keep some powder dry in case we come across some investment opportunities at bargain prices. We would only do what is in the best interest of the client to create wealth for our clients over time.

Management team

Ajaya Jain – Director

Ajaya Jain was the promoter of the company back in 1995. He has 29 years of experience as an equity broker based in Mumbai, India. Prior to that, he was a practicing Chartered Accountant for 18 years based in Delhi, India.

He is a Fellow member of The Institute of Chartered Accountants of India; an Associate member of The Institute of Company Secretaries of India and has done his LL.B from Delhi University and B.Com (Hons) from Shri Ram College of Commerce, Delhi University.

Abhaya Jain – Director

Abhaya Jain has been a director of the company since 1995. He has worked as Senior Vice President of Bank of America, as Country Manager with Aetna International Inc in India and at senior positions in multinational banks in Saudi Arabia and Qatar for over 28 years.

He is an M.B.A. from I.I.M. Ahmedabad, India and B.A. (Hons) in Economics from St. Stephens College, Delhi, India.

Saurabh Jain – Director & Chief Investment Officer

Saurabh Jain was responsible for starting Portfolio Management Services (PMS) in 2008 and as the Chief Investment Officer, he looks after equity research and managing clients’ portfolios. He has over 19 years of experience in Indian equities and has also worked as an Associate Analyst in equity research in Macquarie Securities India Private Limited for 15 months.

He has an M.Sc Accounting and Finance from London School of Economics and Political Science, London and M.Com from Mumbai University.

Ajaya Jain and Saurabh Jain are actively involved in the management and day-to-day affairs of the company and between them, they have over 48 years of cumulative experience in the Indian capital markets.

Services

Portfolio Management Services

At Astute Investment Management, we offer discretionary Portfolio Management Services (PMS), which means that the choice as well as the timing of investment decisions will rest solely with the Portfolio Manager and as is agreed in the investment management agreement.

Strategy – Equity

‘Multiplier’ investment approach

Our approach under discretionary PMS called ‘Multiplier’ aims at capital appreciation in the medium to long term through investment in equities. Even though ‘Multiplier’ is multi-cap oriented, there is a bias towards investing in mid to small cap companies which are under-researched and under-owned and those which offer significant growth prospects. We are sector agnostic and look for opportunities in all sectors provided the companies meet our criteria. We believe that good investments (provided you have a strong filter) are only a few in a year and we would like to focus only on one approach where stocks which meet our criteria (taking into account the risks) are bought for portfolios. We are not of the belief that there is a need to have different approaches (depending on the flavor of the season or what is hot or fashionable) just to be able to raise more money from clients. There is a need for only one approach which we believe more than adequately covers all investment opportunities that we may come across.

Features of PMS approach ‘Multiplier’

- Minimum investment of Rs 50 lakhs

- Various statements (Portfolio performance statement, Holding statement, Transaction statement etc) on a quarterly basis

- Investments in this approach will be only as per SEBI’s rules and regulations on PMS

- The securities/funds will be held in the name of the client

Performance track record

As on 31st December 2023

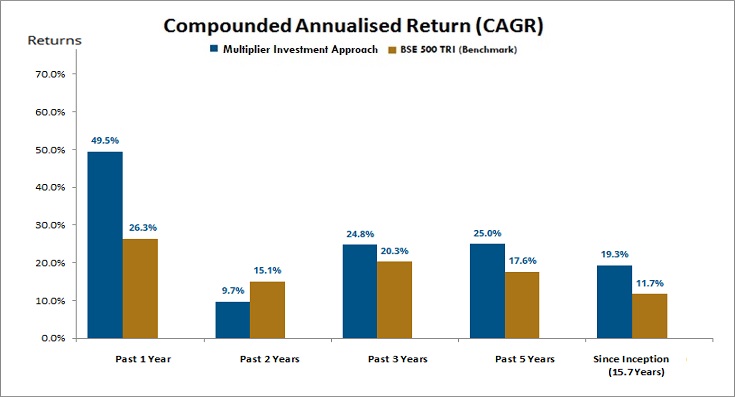

Since inception, the ‘Multiplier’ PMS approach has delivered a CAGR of 19.3% vs. BSE 500 TRI return of 11.7% (an outperformance of 7.6% CAGR))

Rs 1 crore invested in the ‘Multiplier’ PMS investment approach on 24th April 2008 (Inception date) has grown to Rs 16.01 crore as on 31st December 2023 as against Rs 5.67 crore had it been invested in BSE 500 TRI.

*Data source: Capitaline

Please Note:

The above returns are calculated using ‘Time Weighted Rate of Return’ or TWRR method, with the unit-based or daily NAV methodology. The returns of all the clients (including discontinued clients) are aggregated to arrive at the numbers. The returns of our approach are calculated post all fees and expenses and includes dividend. Returns of individual clients may differ depending on time of entry into the investment approach. Past returns are no guarantee of the future returns to the client. For calculating the returns of the benchmark, total return indices are taken.